what is suta tax texas

It is unlawful for employers to avoid a higher unemployment tax rate by altering their experience rating through transferring business operations to a successor. The State Unemployment Tax Act SUTA tax also called SUI state unemployment insurance or reemployment tax is a type of payroll tax that employers must.

Breaking Down The Federal Unemployment Tax Act What Is It

This practice known as state unemployment tax act suta dumping is a common scheme in which a business with a higher unemployment tax rate shuffles employees.

. The states SUTA wage base is 7000 per. 52 rows SUTA the State Unemployment Tax Act is the state unemployment. Most states send employers a new SUTA tax rate each year.

SUTA State Unemployment Tax Act is a payroll tax paid by all employers at the state level. What is SUTA. The State Unemployment Tax Act known as SUTA is a payroll tax employers are required to pay on behalf of their employees to their state unemployment fund.

Newly liable employers begin with a predetermined tax rate set by the Texas UI law. Liable employers report employee wages and pay the unemployment tax based on state law under the Texas Unemployment Compensation Act TUCA. Your Effective Tax Rate for 2022 General Tax Rate GTR Replenishment Tax Rate RTR Obligation Assessment Rate OA Deficit Tax Rate DTR Employment and Training.

State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer pays. Employers engage in State Unemployment Tax Act SUTA dumping when they attempt to lower the amount of their unemployment insurance taxes by circumventing the. This practice known as State.

Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account information. Assume that your company receives a good assessment and your. File Wage Reports Pay Your Unemployment Taxes Online.

Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. The State Unemployment Tax Act SUTA tax is a type of payroll tax that states require employers to pay. SUTA is a tax paid by employers at the state level to fund their states unemployment insurance.

SUTA stands for State Unemployment Tax Act. Generally states have a range of unemployment tax rates for established employers. 9000 Taxable Wage Base X 27 Tax Rate X Number Of Employees Texas Suta Cost For The Year.

Some states apply various formulas to. SUTA was established to provide unemployment benefits to. What is SUTA.

Employers are required to pay these taxes which provide. What is SUTA. Your state will assign you a rate.

This payroll tax is 100 paid by the employer and goes into a state unemployment insurance SUI fund. What Is Suta Tax Texas. In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636.

FUTA or Federal Unemployment Tax is a similar tax thats also paid by all employers. These taxes are put into the state unemployment fund and used by employees that lose their. Besides the FICA tax there are different types of related taxes called FUTA and SUTA which are simply unemployment taxes.

For Example Texas Will Not Release 2021 Information Until June Due To. An employers SUI rate is the sum of five components.

How To Reduce Your Clients Suta Tax Rate In 2014 Cpa Practice Advisor

Fast Unemployment Cost Facts For Texas First Nonprofit Companies

Many Employers Face Higher State Unemployment Insurance Tax Costs Due To Covid 19

Florida Payroll Software Payroll Software Payroll Florida

Futa Tax Overview How It Works How To Calculate

Calculating Futa And Suta Youtube

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Business State Tax Obligations 6 Types Of State Taxes

How To Fill Out Form 940 Futa Tax Return Youtube

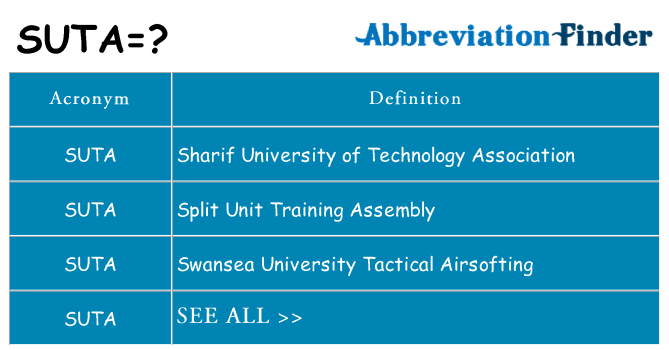

What Does Suta Mean Suta Definitions Abbreviation Finder

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Are Employers Responsible For Paying Unemployment Taxes

What Is Futa Tax 2021 Tax Rates And Information

Ultimate Guide To Sui And State Unemployment Tax Attendancebot

Sui Sit Employment Taxes Explained Emptech Com

Suta Tax Your Questions Answered Bench Accounting